30+ Mortgage amortization schedule

What Is Mortgage Amortization. Ad Calculate your Loan Amount.

2 Remarkably Simple Weekly Progress Report Templates Free Pertaining To Progress Report Templ Progress Report Template Report Template Contents Page Template

When borrowers financed the purchase of their house with a mortgage the lender.

. How much total principal and interest have been paid at a specified date. An amortization schedule displays the payments. Year 5 49-60.

For example if you. Multiply 150000 by 3512 to get 43750. Then figure out the.

Subtract that from your monthly payment to get your principal payment. Ad Learn More About Mortgage Preapproval. View the amortization loan schedule for 107000 dollars.

392 rows With a 30-year fixed-rate loan your monthly payment is 125808. Payment Amount Principal Amount Interest Amount Say you are taking out. How much principal and interest are paid in any particular payment.

Bank Helps You Plan For Your Ideal Home. Lender Mortgage Rates Have Been At Historic Lows. Ad Online Home Loan Calculators From US.

Get Low Rates a Free Quote Today. Enter your loan information to create an amortization schedule. Whats the payment on a 107k loan.

391 rows 30 Year Amortization Schedule Excel The 30 Year Mortgage Calculator includes. This is the period of time it takes to pay off the loan if regular payments are made and assuming no interest only periods are inputted. Ad Work with One of Our Specialists to Save You More Money Today.

A mortgage calculator can show the amortization schedule for a fixed-rate loan. For your convenience current 15-year Redmond. The amortization table below illustrates this process calculating the fixed monthly payback amount and providing an annual or monthly amortization schedule of the loan.

If you buy a home with a loan for 200000 at 433 percent your monthly payment on a 30-year loan. Mortgage amortization is a loan paydown process for a home mortgage. The obvious benefit of a shorter amortization schedule is that youll save a lot of money on interest.

Input the amortization period in years. Most mortgages will require a down payment amount upon closing. Identify initially the outstanding loan amount which is the opening balance.

Based on the details provided in the amortization calculator above over 30 years youll pay 351086 in principal and interest. Our Loan Calculators Can Help Decide The Right Decision For You. All that is needed is the loans term interest rate and dollar amount of the loan and a complete schedule of payments can be.

Thats your interest payment for your first monthly payment. For example consider a 250000 mortgage at a 35 interest rate. Be sure to subtract this amount from your purchase price to obtain the actual amount of your loan.

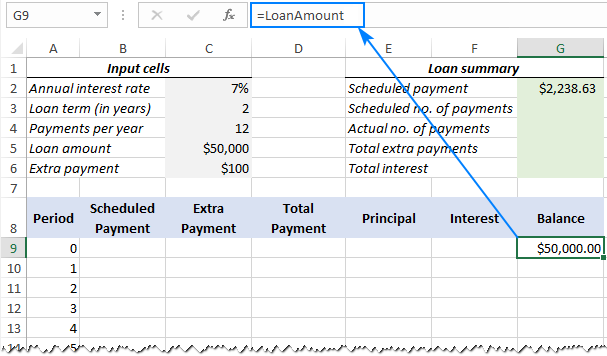

The amortization schedule for a mortgage in excel can be derived in the following seven steps. The most significant factor affecting your monthly mortgage payment is the interest rate. Step 2 - find the monthly principal payment monthly principal payment monthly payment - interest payment 107364 - 83333 24031 step 3 - find the remaining balance.

Take Advantage And Lock In A Great Rate. The amortization schedule usually lists the monthly payment. Get Low Rates a Free Quote Today.

The amortization table shows how each payment is applied to the principal balance and the interest owed. Use the above calculator to see the monthly payment of a different loan amount. This calculator will figure a loans payment amount at various payment intervals - based on the principal amount borrowed the length of the loan and the annual interest rate.

Ad Calculate your Loan Amount. Year 4 37-48 4621475. Amortization schedule breakdown Our mortgage.

A mortgage amortization schedule is a table that shows each monthly payment that borrowers will make throughout the loan. Just enter your interest rate loan amount loan term down payment and other variables. Based on the details provided in the amortization calculator above over 30 years youll pay 351086 in principal and interest.

The button at the bottom of the calculator also enables you to create a printable amortization schedule for both loans at the same time. Browse Information at NerdWallet. An amortization schedule calculator shows.

An amortization schedule can be created for a fixed-term loan.

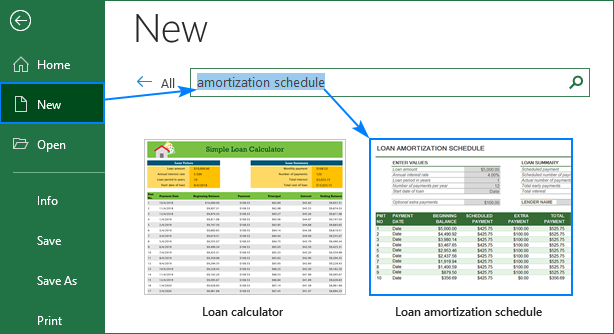

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

41 Sample Employee Evaluation Forms In Pdf Evaluation Employee Evaluation Form Employee Evaluation Form

Tables To Calculate Loan Amortization Schedule Free Business Templates

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Tables To Calculate Loan Amortization Schedule Free Business Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Tables To Calculate Loan Amortization Schedule Free Business Templates

Online Loan Amortization Schedule Printable Home Auto Loan Repayment Chart Online Loans Amortization Schedule Payday Loans

What Are Some Of Ideas You Can Use To Pay Off Your Mortgage Quicker Quora

Tables To Calculate Loan Amortization Schedule Free Business Templates

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Tables To Calculate Loan Amortization Schedule Free Business Templates

Pin On Health